[show_post_categories show=”category” hyperlink=”yes”]

[show_post_categories show=”tag” hyperlink=”yes”]

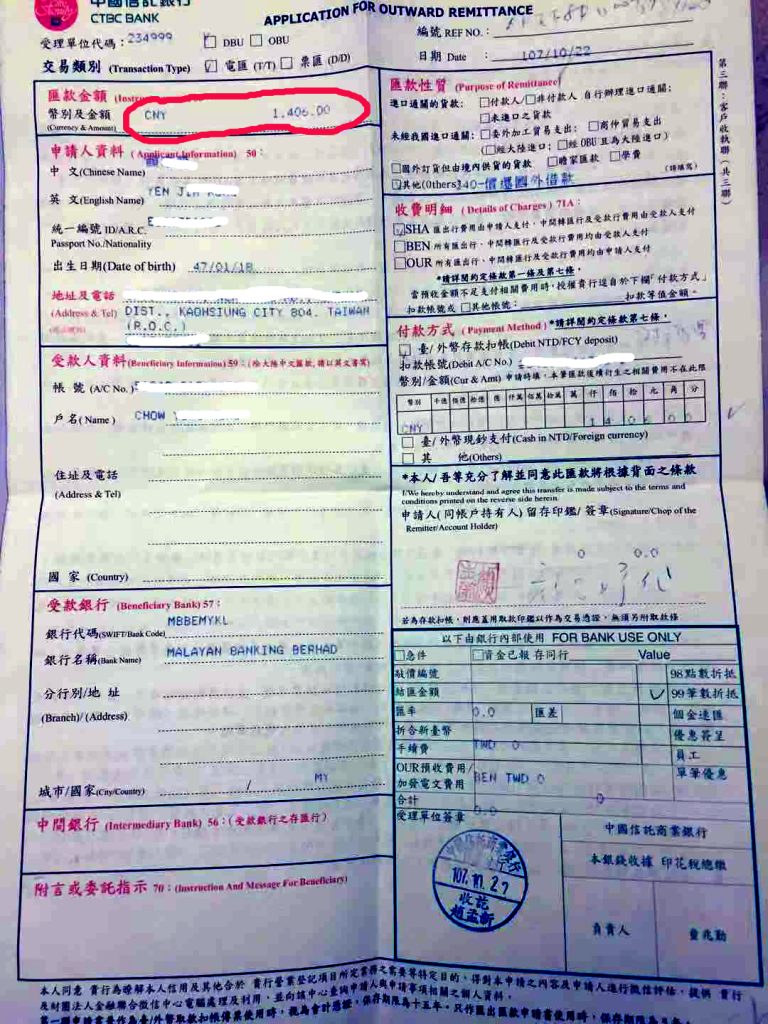

How much (as a percentage of fund) would you guess it cost to transfer RMB 1,406 from Taiwan to Malaysia using the traditional banking services? In this article I share my expensive lesson on international fund transaction using traditional banks. A staggering 27.46% of my fund of RMB 1,406 was “taxed” by the intermediary. Both the sending bank (in Taiwan) & receiving bank (in Malaysia) said that there it was not possible to find out how the intermediary levy the charges!

Used a traditional route for international fund transfer

As my recent trip was sponsored, I was expecting reimbursement from the sponsor for the cost of my trip. To facilitate the process, the sponsoring university in China would pool our group’s reimbursements and let the organizer of the trip, Dr. Yan to do the individual distribution of the fund received.

There was just one issue for me: the organizer and all the rest of the members of our group are based in Taiwan with yours truly being the only one located in Malaysia. Nevertheless my modest claim (after deducting the RMB 500 loaned to me by Dr. Yan to alleviate my having left my wallet at home at the start of the trip!) was RMB 1,406 (about US$202). Dr. Yan’s office was resourceful enough to use one of his bank’s “transaction fee waiver” vouchers in an attempt to keep the transaction fees down for me.

At Malaysia’s end, previous experience told me that MayBank (Malayan Banking Berhad) would only levy a charge of RM5 (US$1.19) for the transaction. Of course it would have made from the spread when converting the currency into Malaysian ringgit.

Whopping 27.46% transaction fees!

Based on the exchange rate of RMB 0.59 to RM 1.00, after deducting transaction fees, I was expecting to receive at least RM 750. When the fund finally arrived at my bank, I had a big shock.

From the RMB 1,406 remitted by Dr. Yan’s office, only RM 597.70 equivalent to RMB 1,019.96 arrived at my MayBank account. The meant that a whopping RMB 386.04 or 27.46% of the original RMB 1,406 remitted was deducted as the transaction fees!

Both Taiwanese and Malaysian did not levy any transaction fees

I contacted Dr. Yan’s office and his people double checked with his bank in Taiwan to confirm that the amount transferred from Taiwan was indeed RMB 1,406. This was confirmed via the transaction slip sent to me from Taiwan. There was also no fees levied by the Taiwanese bank on the RMB 1,406.

Next, I went to my bank, MayBank to get the full details of this transfer. I was told that MayBank did not levy any fees on the transaction but the transaction report indicated that only RMB 1,019.96 was received at the Malaysian end. I was told by MayBank that they only processed the amount that was received, that is RMB 1,019.96 and it has no idea on what was the transaction fees levied by the intermediary.

I conveyed MayBank’s findings to Dr. Yan’s office which in turn also confronted their bank in Taiwan. The conclusion given by the Taiwan bank was that they had remitted RMB 1,406 and the differential must be the transaction fees (including the spreads for converting from RMB to various intermediary currencies before the final conversion to RM). To make matters more confusing, the Taiwanese bank said that it had no control over how much its intermediary would charge.

Traditional remitting equals to having no idea of the transaction cost

It then became clear to me that for traditional bank remittance from overseas, the customers really are at the mercy of the intermediaries. The remittance cost is not transparent. It thus makes this a very risky and expensive choice to remit money. And both the sending and receiving banks will wash their hands off should a customer like me getting fleeced by the intermediary (27.46% is a huge amount to levy as a remittance fee).

Better to use remittance service provider that are transparent in their fees

MoneyGram

I made a check with MoneyGram’s website to see if we were to transfer an equivalent of RMB 1,406 in US dollars (i.e, US$ 202) from Taiwan to Malaysia, with receiver paying the transaction fees what kind of scenario would happen.

As shown above, if we were to use MoneyGram, I would be getting at least RM 770.49 from the RMB 1,406 or US$ 202 that were to be remitted with a fees of only US$ 15 (or RM63 or RMB105). Thus with a exchange rate of RMB 1.00 = RM 0.59, this means I would have received RMB 1,305.92. The overall remittance and conversion cost in this case would be around RMB 100.08 or just 7.12% of the amount transacted.

Western Union

A check with Western Union shows that for a similar amount in US$, the cost of transaction would be around US$10. But since Western Union also make from a spread on conversion, for US$192, at US$1 = RM3.8539, I would only get RM739.95 or equivalent of RMB 1,254.15 Thus the overall remittance and conversion costs would actually be RMB 151.85. The total remittance cost would have been 10.80% of the amount remitted.

In both MoneyGram and Western Union cases, regardless of the total cost of the transfer of fund, the costs were pretty transparent. And even with the higher spread on currency conversion, Western Union would only have an overall cost of around 10.80% of the sum to be transferred. Of course the best choice would have been MoneyGram which has an overall cost of 7.12%.

Lesson Learned

- Never use traditional banks for international remittance.

- Zero “transaction fees” for international remittance is a misnomer. There is a spread when currencies are converted at the sending and receiving ends. This is how banks make their money!

- Intermediaries for traditional bank remittance (aside from MoneyGrams and Western Union) do take big cuts out of your total amount to be transferred overseas!

- Make sure the remittance service gives you a transparent total fees before committing to any overseas remittance.

In my case, since both Dr. Yan and I have WeChat China Wallet, it would have been better that we had explored this route where virtually there would be no cost of transaction. The only problems are: Dr. Yan needs to load his WeChat China Wallet with sufficient funds and at my end, I could only spend the amount in my WeChat China Wallet in China!